House flipping is a great opportunity to make extra income, especially for those who love renovations and have the ability to make old houses look new again. If you don't have the right knowledge, house flipping can be dangerous and risky. It's important to understand the process before you get started so that you can avoid common mistakes.

How to Become a House-Flipper

The first step in becoming a house flipper is to set your goals and create a business plan. This will help you determine the type of properties that you want to flip and how much money it will cost. It also helps you identify the experts you'll need.

You can then search the MLS for homes that match your criteria. The database contains information such as price, square footage, number bedrooms, bathrooms, and other details.

Once you've found a home that meets your requirements, it's time to negotiate the purchase with the seller. While you don't need to match the asking price of a home, it is important that you offer a fair deal to allow you to make a profit.

Partnering with a realtor who has been successful in flipping homes can be a great way to get started in real estate. They will have tips for renovating the house so it is more appealing to potential buyers.

They can also give you an accurate estimation of the property's market value. This will help you set the right price for your next project.

Another important thing to consider is how you're going to finance your flips. Depending on what type of house you are buying, you have the option to use either a standard or hard money mortgage to finance your projects.

Before you flip, it is important that you consider your income and credit score. Many loan providers won't approve borrowers for loans if they don't believe your income or credit history will be stable enough to repay the installments.

If you want to flip houses it is important that you follow the 70% rule. That means that you shouldn't pay more than 70% on the ARV (after-repair value) of the house. This strategy is one that many successful investors use to ensure they are making a profit from their investments.

It is a good idea to work with someone who is already a successful house flipper in order to be mentored. This will give you the opportunity to learn and gain experience in the trade before you attempt it yourself.

You can then start flipping houses yourself and create a successful business. The perks of owning your own business are that you're in charge and can do as you please with it, from hiring the right experts to deciding how many houses you want to flip each year.

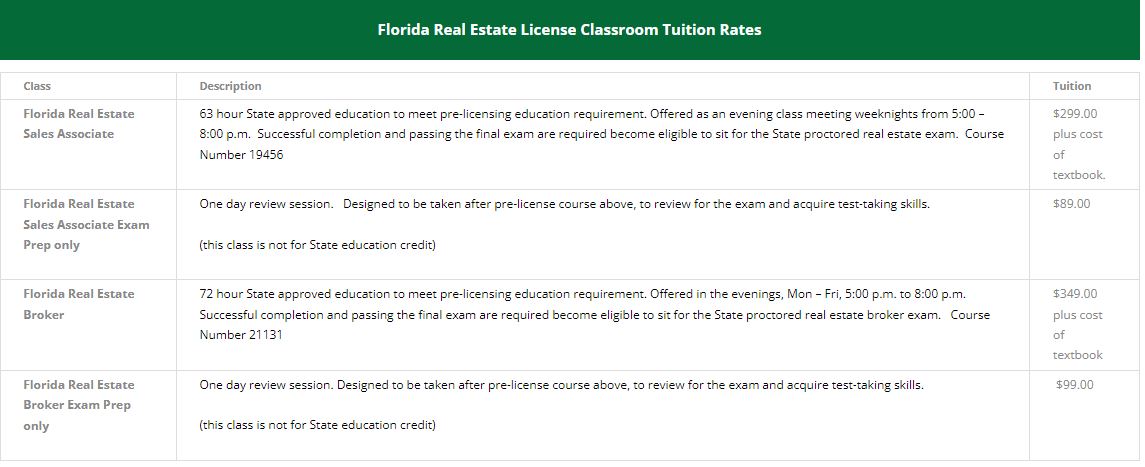

You should get a license to flip houses if you want to make a career out of it. You will be able to legally represent yourself and you will have access to a variety of resources that can help you become a successful house flipper.

FAQ

How do I calculate my interest rate?

Market conditions impact the rates of interest. The average interest rate over the past week was 4.39%. The interest rate is calculated by multiplying the amount of time you are financing with the interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

What is the cost of replacing windows?

Window replacement costs range from $1,500 to $3,000 per window. The cost to replace all your windows depends on their size, style and brand.

How long does it take for a mortgage to be approved?

It is dependent on many factors, such as your credit score and income level. Generally speaking, it takes around 30 days to get a mortgage approved.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to find an apartment?

Finding an apartment is the first step when moving into a new city. This process requires research and planning. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. Although there are many ways to do it, some are easier than others. Before renting an apartment, you should consider the following steps.

-

Online and offline data are both required for researching neighborhoods. Online resources include Yelp. Zillow. Trulia. Realtor.com. Other sources of information include local newspapers, landlords, agents in real estate, friends, neighbors and social media.

-

Read reviews of the area you want to live in. Yelp, TripAdvisor and Amazon provide detailed reviews of houses and apartments. You can also find local newspapers and visit your local library.

-

Make phone calls to get additional information about the area and talk to people who have lived there. Ask them what they liked and didn't like about the place. Ask if they have any suggestions for great places to live.

-

You should consider the rent costs in the area you are interested. Consider renting somewhere that is less expensive if food is your main concern. On the other hand, if you plan on spending a lot of money on entertainment, consider living in a more expensive location.

-

Learn more about the apartment community you are interested in. Is it large? What is the cost of it? Is it pet-friendly? What amenities does it offer? Can you park near it or do you need to have parking? Are there any special rules that apply to tenants?