There are many things you should consider when deciding if being an agent in real estate is the right career. These can range from getting your license to interacting with other real estate professionals and clients. Earning money will be easier if you have more knowledge.

Getting a real estate license

You might consider a real estate license if you're looking to have a flexible job but still need to have a lot of knowledge. Unlike other jobs that require many years of experience, becoming a real estate broker is relatively easy to start and can provide you with a lucrative income. Being self-motivated, having good relationships in the community, and being willing to work hard are key ingredients to success as a real estate broker. While the earning potential is huge, it's also important to understand that you will have competition.

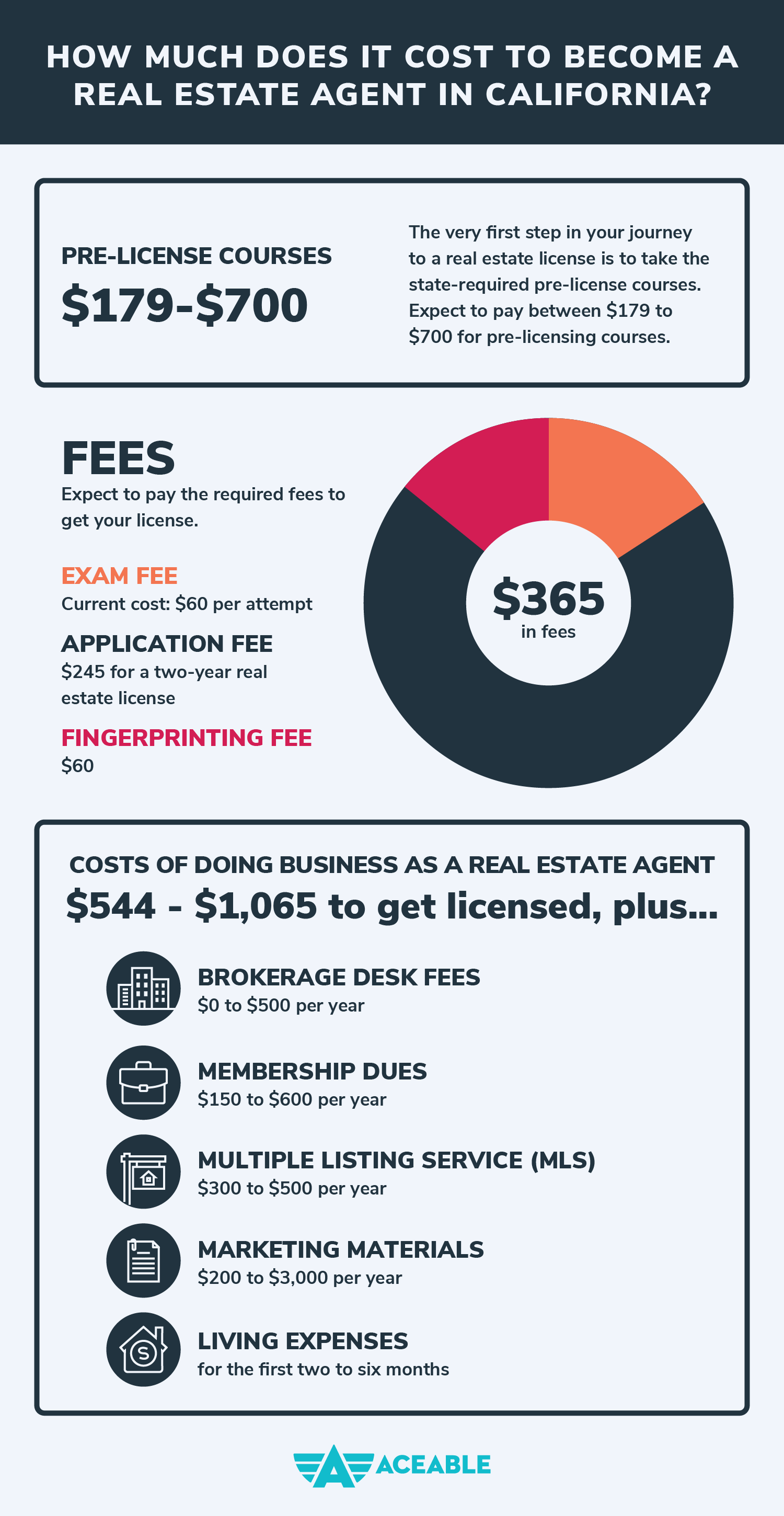

In order to become a licensed real estate agent, you need to pass a test. It's not an easy test, and many people fail it their first attempt. In fact, some people never even pass it. To pass the exam, you will need to score at least 70 percent. Ideally, you should have solved at least 53 questions.

Getting clients from a real estate broker

Get online if you want more clients for your real-estate brokerage. Event hosting can help you build relationships and provide information. You can even host social events where you can meet potential clients.

To get clients for your brokerage, the first step is to create a compelling site. Promoting your free services is also important. Free services include complimentary photography and a market analysis. These are not essential, but can save your clients hundreds.

A real estate broker can earn a living.

Earning a living as a real-estate broker is a great way to use your expertise and knowledge of your local housing market to help others. Flexible hours are possible, and you may work weekends and evenings. Before you start your career, make sure to research licensing requirements and do your homework. For example, you might need to undergo a background check and fingerprinting, or you may have to pass an exam to be registered as a real-estate agent.

A real-estate broker's income can be extremely lucrative. In Austin, for example, a real-estate agent can earn up to $88,996 annually, which is 13% higher than the national average. Nearly one million people live in this city, which is rapidly growing due to its tech scene. Agents who want to work in a large city with a growing populace will be thrilled by this news. Depending on the area and the average sales price, the average commission for a realtor is between three- and seven percent.

Collaboration with other professionals in real estate

Real estate brokers work with people from all walks. You may have to deal with difficult clients, stressed sellers, and competitive agents. You may also have to work weekends and long hours. This field can have a demanding workload. You need to be able and comfortable working under intense stress. You will also need to manage multiple properties and manage uncertainty.

You will need to collaborate with other real-estate professionals and stay on top of market changes as a broker. To be able to complete tasks on time, you will need to have discipline. To be successful, it is crucial to set daily goals and plan your work for weeks and months in advance. It's also crucial to set aside time for networking and professional development.

Stress of the job

Many agents who work in real estate experience high levels of stress. They have to deal not only with angry buyers and sellers who are desperate, but also with strict mortgage lenders. All of these factors can lead to high stress levels, which can impact your physical health.

The stress can be overwhelming at times, but there are people who thrive on it. There are ways to balance the demands of your job and your personal life. You can manage the stress that comes with real estate by following these stress management tips.

FAQ

How do I know if my house is worth selling?

If you have an asking price that's too low, it could be because your home isn't priced correctly. If you have an asking price well below market value, then there may not be enough interest in your home. To learn more about current market conditions, you can download our free Home Value Report.

How many times do I have to refinance my loan?

This depends on whether you are refinancing with another lender or using a mortgage broker. In either case, you can usually refinance once every five years.

Is it better to buy or rent?

Renting is usually cheaper than buying a house. However, you should understand that rent is more affordable than buying a house. You also have the advantage of owning a home. You will have greater control of your living arrangements.

Can I buy a house in my own money?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. You can find more information on our website.

Can I get a second loan?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Purchase a Mobile Home

Mobile homes are houses built on wheels and towed behind one or more vehicles. Mobile homes have been around since World War II when soldiers who lost their homes in wartime used them. People who want to live outside of the city are now using mobile homes. There are many options for these houses. Some houses have small footprints, while others can house multiple families. Even some are small enough to be used for pets!

There are two main types for mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This occurs before delivery to customers. Another option is to build your own mobile home yourself. The first thing you need to do is decide on the size of your mobile home and whether or not it should have plumbing, electricity, or a kitchen stove. You'll also need to make sure that you have enough materials to construct your house. To build your new home, you will need permits.

These are the three main things you need to consider when buying a mobile-home. You might want to consider a larger floor area if you don't have access to a garage. Second, if you're planning to move into your house immediately, you might want to consider a model with a larger living area. You'll also want to inspect the trailer. Damaged frames can cause problems in the future.

You should determine how much money you are willing to spend before you buy a mobile home. It is important to compare prices across different models and manufacturers. Also, consider the condition the trailers. There are many financing options available from dealerships, but interest rates can vary depending on who you ask.

Instead of purchasing a mobile home, you can rent one. Renting allows for you to test drive the model without having to commit. Renting is expensive. Renters usually pay about $300 per month.