An escrow officer is a neutral person who holds money or assets for the benefit and protection of all parties to a transaction. State regulation regulates escrow agents and they have a fiduciary requirement to act only according to mutually agreed-upon instructions.

Getting Started

Your agent, or you, will deposit earnest income into an escrow fund until your purchase contract is completed. This money is intended to protect the seller against a buyer who isn’t serious about the deal. It also ensures that your property taxes, insurance and other fees are paid promptly.

Your Rights and Responsibilities

As a depositor or beneficiary you have the legal rights to an audit of how the escrow officer managed your escrow asset. This means that the escrow agent must provide you with a receipt, a copy of your escrow agreement and keep complete and accurate records.

A court order may be issued requiring the escrow agent to release your escrow property. This could lead to money damages. You have the right to request information from the court if the agent fails to keep accurate records of your escrow properties.

Entering Escrow

An escrow officer will be assigned to you and your lender during the home-buying process. The escrow office will track the funds of your lender, pay the real estate agent involved in the transaction and submit documents to recorder's for finalization of the transfer.

The Right to Buy Escrow Services

The majority of escrow services are included with your loan estimate. So you can choose the escrow agent that is best for you. If you're unsure about which escrow services your loan requires, you can ask your lender for an estimate and talk to an agent about your options.

Your Legal Obligations must be adhered to by your Escrow agent

An escrow agent has a fiduciary duty to both the buyer and the seller, and must act only on their mutually agreed-upon instructions. This is a large responsibility. Make sure you work with someone you can trust.

The Escrow Company Definition

An escrow company is a type of title firm that acts as a middleman between buyers and sellers in real estate transactions. These companies may place your deed to a house in escrow for the closing date. They also may pay taxes or other bills on your behalf.

Each escrow company that you choose will have its own rules and regulations. Before agreeing to work together, make sure to carefully read these. An escrow firm that provides excellent service will be a good choice for you and your fellow home-buyers.

FAQ

What flood insurance do I need?

Flood Insurance protects against damage caused by flooding. Flood insurance helps protect your belongings and your mortgage payments. Find out more about flood insurance.

What is a Reverse Mortgage?

A reverse mortgage is a way to borrow money from your home without having to put any equity into the property. It allows you access to your home equity and allow you to live there while drawing down money. There are two types: conventional and government-insured (FHA). You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers repayments.

How many times can my mortgage be refinanced?

This is dependent on whether the mortgage broker or another lender you use to refinance. In both cases, you can usually refinance every five years.

How long does it take for my house to be sold?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It may take up to 7 days, 90 days or more depending upon these factors.

Can I get a second mortgage?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage can be used to consolidate debts or for home improvements.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

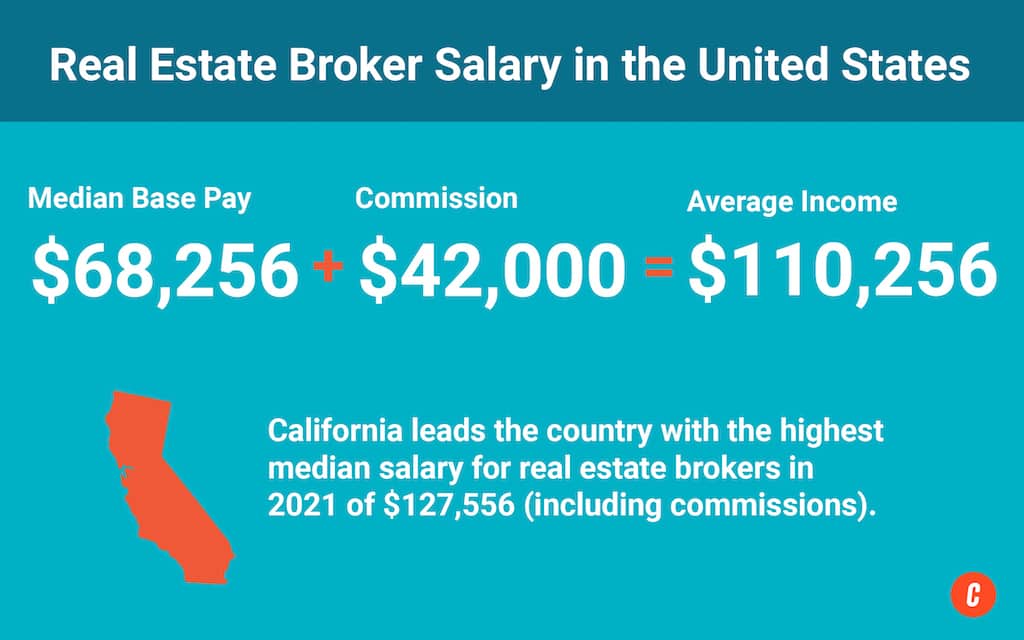

How to become a broker of real estate

You must first take an introductory course to become a licensed real estate agent.

The next step is to pass a qualifying examination that tests your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

Once you have passed the initial exam, you will be ready for the final. To become a realty agent, you must score at minimum 80%.

All these exams must be passed before you can become a licensed real estate agent.